Network Effects

Public, Private, & Government regulated payment networks will bump into each other more and more as finance is "democratized". Is there enough pie for everyone or is a payment network war inevitable?

Network Effects is a buzzword which has been flying around the Tech industry since 1994 when George Gilder coined the term. It’s since become a trite saying right up there with “Synergy”, “Disruptive (Technology)”, and “New Normal”.

Network Effects are the reason AT&T became a monopoly, why we still use Microsoft word and Google search, and why there may be conflict looming between the Fed, Banks, DeFi, and Visa/MasterCard.

Here’s how we’ll break it down:

What are the different types of payments networks?

What are payment network effects?

Why is this a catalyst for friction?

Where does the payments world go from here?

If you’re interested to learn more on this and other financial topics, consider subscribing using the button below!

1. What are the different types of payment networks?

The oldest and most well established payment networks are Government Regulated; that is to say some sort of government approval is required to be a member of the network. These include ACH (how 93% of Americans receive their paychecks), Wire, and some extent checks.

Let’s take ACH for example: If I want to pay my gas bill online, I need to go to my Bank and ask them to send the money to the gas company. The Bank submits the payment on my behalf to the network. In order to be a member of the ACH network, you have to be a registered Financial Depository Institution (FDI) which means getting a government charter.

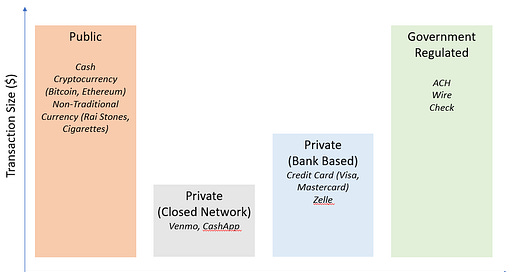

Private payment networks are payment channels which anyone (a card holder, mobile wallet owner, P2P user) can submit transactions. Rails like Visa/Mastercard, Zelle, Venmo, and CashApp are the one’s individuals interact with the most in this category.

Within this category there are bank based networks (Visa, Mastercard, Zelle) and closed networks (Venmo, CashApp). Bank based channels resemble Government Regulated channels — credit card transactions are ultimately settled via ACH after all— and ultimately involve financial institutions; while closed networks never have cash leave the system, meaning settlement and clearing are done in-network. (Note: this is effectively how transactions between two accounts at the same bank work, aka “on-us” transactions)

Public payment networks include Cash and crypto. Crypto is great because it’s not regulated by a central body, allowing for anonymity, and is a closed system which doesn’t require a deposit bank — just an internet connection. Cash allows for the many of same benefits, though transportation and security of large quantities makes payments difficult in large values.

2. What are Payment Network Effects?

Payment Network: system which connects people and businesses and aids in the clearing (approving) and settlement (real transfer of money) of payment transactions

Network Effects: a phenomenon whereby a product or service gains additional value as more people use it

Payment Network Effects: a phenomenon whereby a payment network gains additional value as more people use it

Network effects had their first day in the sun during the late 90’s as the Internet was trying to figure out ways to monetize itself and then again as the world learned to Google and got their first look at The Facebook (too Meta?). The most recent bump coming in 2013 with the emergence of Bitcoin.

If you recall my earlier post on Credit Cards, the network didn’t take off in volume until there was a critical mass of (1) users wants to use the card, (2) merchants willing to accept the card, and (3) technology & innovation to serve as catalysts for growth. In other words, there wasn’t enough value in the network.

3. Why is this a catalyst for friction?

The value of the network effect can be quantified by using Metcalfe’s law — the idea that the value of a network is a function of the number of users in the network— something Bitcoin apologists have been doing to “fairly value” the currency for years.

If you want the short answer: the recent expansion of the crypto user base due to accessibility & visibility will cause incumbency fears to as the Fed dreams of launching a “Digital Dollar”.

The following leans heavily on the excellent work done by Dmitry Kalichkin at Cryptolab Capital, go check them out if you want to learn more about crypto valuation methods and investing.

Using data sourced from Visa’s quarterly operational metrics, Ycharts and Blockchain.com, we generate intercepts and slope coefficients for lower and upper bounds with the input variables being n*log(n) and n^2, respectively, where n = total number of cards issued (Visa) and 30 day moving average for number of active wallets (Bitcoin), and the target variable being the market capitalization:

Lower Bound = a1 + b1 * ln(n*log(n)) --> ln(Market Cap)

Upper Bound = a2 + b2 * ln(n^2) --> ln(Market Cap)

n = # of Cards Issue (Visa), 30 Day MA # of Active Wallets (Bitcoin) We can see that Bitcoin market cap and fair value bounds are much more volatile due to the intense fluctuations in number of daily active users, particularly in 2018 in the wake of the 2017 Bull Run. Visa, on the other hand, only deviated once when following the rest of the market down in the Breaker Tripping March 2020 selloff.

If we could go back and look at the market cap of Visa in the early 1980s, the chart would likely look just as volatile as new merchants came online or switched to rival MasterCard (prior to merchant’s banks being able to accept all cards).

To drive home the point of network users = value, check out this thread:

The US government has talked about joining the growing list of stable coins (cryptocurrencies with reserves of actual currency) but the difference here is that the Central Bank would issue a Digital Currency, CBDC for short, backed by the full faith of the US Government.

There are a lot of coins out there, and one that could be easily debased by BRRR might not land well with digital currency natives, which may lead to low adoption rates.

So if more users = more value, then the network with the most users will eventually win out over the others, crushing new entrants with incumbency bias, right?

People are capable of using multiple networks at once…and the government has no qualms mandating certain channels be used: Banks were required to take payments via ACH from the Government for various disbursement programs.

4. Where does the payments world go from here?

Regulation! (probably)

There’s nothing like regulation to crash a market. As more and more crypto exchanges come online, there are legitimate concerns that the market will see a sharp crackdown. How a sovereign nation regulating a global, decentralized network would work beyond banning URLs within a country is still up for debate.

If the Fed is worried about being late to the party, they shouldn’t be. CBDCs have the chance to bring much needed stability to the market, something that institutional investors would love. It would provide a way for the underbanked to gain access to digital payments outside of pre-paid debit cards or Venmo/CashApp.

The pie, it seems, is big enough for everyone to get a slice.

If you liked it, please consider sharing, subscribing, and following me on Twitter! See y’all on the 21st!

Cheers,

Wilson