Payment Systems as Public Infrastructure

A note on viewing payments as a public commons and thoughts to consider for the incoming administration.

In a conversation this week, a more philosophical point came up around the critical role payment systems play in the modern economy. Without the Federal Reserve, NACHA, Visa, Mastercard, payment service provides, and a slew of other players, the US economy would grind to a halt. People wouldn’t receive paychecks and couldn’t buy food or pay mortgages. Businesses wouldn’t be able to pay invoices, receive funds, or have their shipments released. Payment operators are systemically important or, put another way, too big to fail.

To see how important they are, we need not look further than electronic annual down time for a payment operator. Whether due to errors, maintenance, or upgrades, it’s now measured in seconds compared to minutes in 2002. So of the 31.5 million seconds in 2024, major players like Visa, Stripe, or Adyen were down for less than 32 seconds — a 99.9999% uptime. This is because a network outage for something like Visa, which manages more than a third of global card swipes, can have massive repercussions.

An estimated 560 million transactions occur in the US every day. If an electronic payment network is down for even a minute, that can mean hundreds of thousands of transactions fail. That failure represents invoices going unpaid, salaries not being delivered, or groceries going unpurchased. And yet, it doesn’t. The whole ecosystem (from a payer’s perspective) hums along quietly in the background. It’s to the point where we don’t know, or care to know, what’s going on during each swipe or tap — it just works. I’ve waxed poetic on this topic before:

Today’s innovations may as well be magic to you and me. Few have a background in the 50+ years of innovations in electronic communication, network processing, and encryption which have occurred since the first credit card swipe in the late 1960s. As new tools like AI and distributed ledger technology get added to the mix, the well from which one must drink to gain comprehension only grows deeper.

The magic tarnishes and becomes mundane with time and exposure, until you’re left with less of an innovation and more a piece of background infrastructure. It’s important, yes, but only insofar as it powers the technology resting upon it. As we “stand on the shoulders of giants” from the past, we must keep in mind that our shoulders are the ones upon which others will one day rest.

Infrastructure enables other things to occur. In the physical world, infrastructure like roads, bridges, airports, and railways enable people and goods to conduct business and live their lives. As scholar Brett Frischmann writes, "[infrastructure] shapes the available opportunities of [people and businesses] to participate in [economic, social, and political] systems and to interact with each other.”1 He later continues:

[I]nfrastructure resources are basic inputs into a wide variety of productive activities and infrastructure users who choose to engage in such activities often produce public and social goods that generate spillovers that benefit society as a whole. Managing such resources as commons may be socially desirable from an economic perspective because doing so facilitates these downstream productive activities.

This is why governments have long sought to standardized payments and smooth the transaction process. Standardized bills, par banking, Fedwire, MICR, ACH, and RTP/FedNow are all examples of public or private entities stepping up and making the experience better for all users.2 In the last fifteen years, new technology and attitudes toward payment operators have led to renewed (and sorely needed) investment in payment infrastructure. Governments and consortiums have sought to incubate (or in India’s case actively tip the scales for) growth in faster, modern payment networks. From a recent World Bank blog:

…when designed to serve as digital public infrastructures, fast payments can help foster competition and economy-wide digital transformation, serving as key components of e-commerce models and e-government innovations supported also by new overlay services such as “request to pay” and the use of quick response (QR) codes.

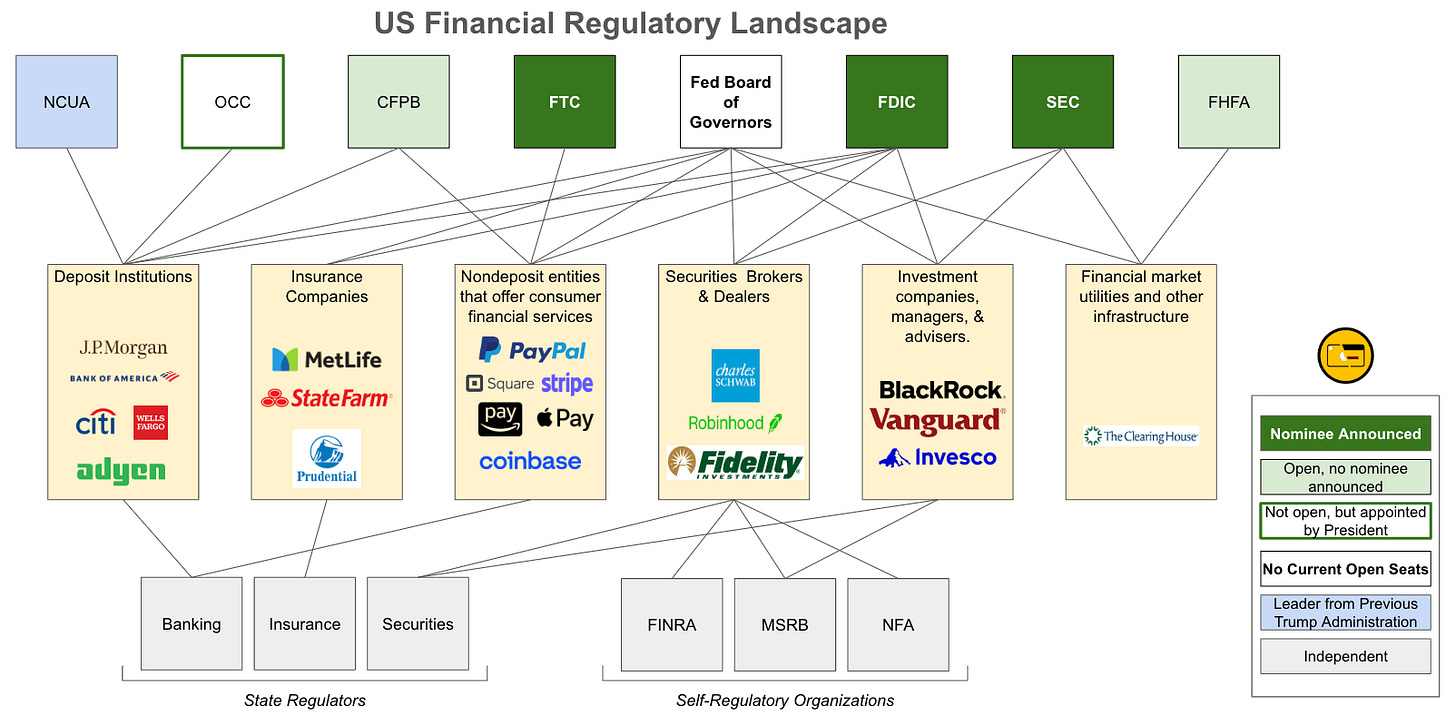

As the U.S. welcomes a new administration, there is an opportunity to change how the government guides the fintech and payments industry. Expectations are that the new leaders will be friendly to innovation and light on regulation. The nominees to lead the Treasury (which oversees the OCC, FinCen, and CDFI), Commerce Department, FTC, and SEC have observers eager to welcome the new administration and an innovative era. To help develop a sense of why everyone’s excited, we can take a look at how these organizations interact with various financial industry players.

Despite the optimism, there are indications that lawmakers and regulators may continue imposing new regulations, potentially disrupting large firms while creating opportunity for disruptors. A potential bipartisan cap on interest fees and other proposed changes may disrupt large banks, though more friendly regulators at the OCC and CFPB may unlock a wave of spending on M&A and R&D. That said, the lighter regulations around M&A combined with a slowdown in CFPB rulings appear poised to most benefit disruptors and emerging players — and thus create a boom in investment. Big tech firms like Apple, Meta, Alphabet, and Microsoft could leverage a gentle regulatory environment to continue advancing embedded finance.

The new administration has the opportunity to cultivate growth in the payments industry while ensuring this growth serves as robust infrastructure for further innovations. Funding, demand, and innovation are now coming to a head and these leaders have the chance to guide the future of how we move and access our funds. Fundamental changes in real-time payments, open banking, stablecoins, and embedded finance can help make finance more accessible, secure, and equitable for future generations.

I encourage those new stewards of the financial system to adopt the public infrastructure approach — prioritizing long-term health and stability over short-term policy wins and political point scoring. Leaders have the chance to regain and retain the US position in payments innovation, but only if they can step back, reframe their thinking, and take the long view.

Frischmann, Brett M., Infrastructure: the Social Value of Shared Resources (Introduction) (January 19, 2012). B. Frischmann, INFRASTRUCTURE: THE SOCIAL VALUE OF SHARED RESOURCES, Oxford University Press, 2012, Available at SSRN: https://ssrn.com/abstract=2000962

I am conscious of the fact that some innovations have benefited certain parties more than others. There’s no getting around that cards made it easier to spend money — occasionally money the cardholder doesn’t have. That said, I believe these have been outweighed by the overall net good for society at large.