The Path to a Real-Time Future

What are real-time payments and how will they change the way we live our lives?

Hello to the 4 new subscribers! Thanks for your support! If you want to join them, consider subscribing.

This will be the first in a multi-part piece on real-time payments. Over the next two months (June 2022 edit: this turned out to be sixth months), we’ll be walking through the origins of real-time payments (RTP), the benefits, and hurdles it’ll need to clear to grow in the US.

I’m really excited to launch into this journey with you and hope you’re able to learn something with me along the way!

Some of the topics we’ll cover include:

What is a Real-Time Payment?

Problems Real-Time Payment solves & Examples of RTP in action

Barriers to Real-Time Payments in the U.S.

The Future for Real-Time Payments

First: What does it mean for a payment to be in “real-time”?

The two core components real-time payments are:

Instant Settlement: the obligation between payer and receiver is satisfied at the moment of the transaction

Instant Availability: the receiver of the payment can spend the funds without delay

I discussed some of the implications of settlement and availability in an earlier piece on the economics of payments. There, we discussed how the speed of settlement and availability often determines who pays for the transaction. In this series, we’ll focus more on the implications of settlement and availability being instant (as opposed to same-day, T+2, or whenever you get around to depositing the check)

Modern real-time payment networks have the ability to settle transactions 24/7/365 — (something that smart contracts and protocols could also solve, but more on that later)

Some examples of real-time payments include cash (yes cash), the RTP Network from The Clearing House, the forthcoming FedNow from the Federal Reserve, UPI in India (the largest RTP market) Zengin in Japan, and TIPS from the ECB.

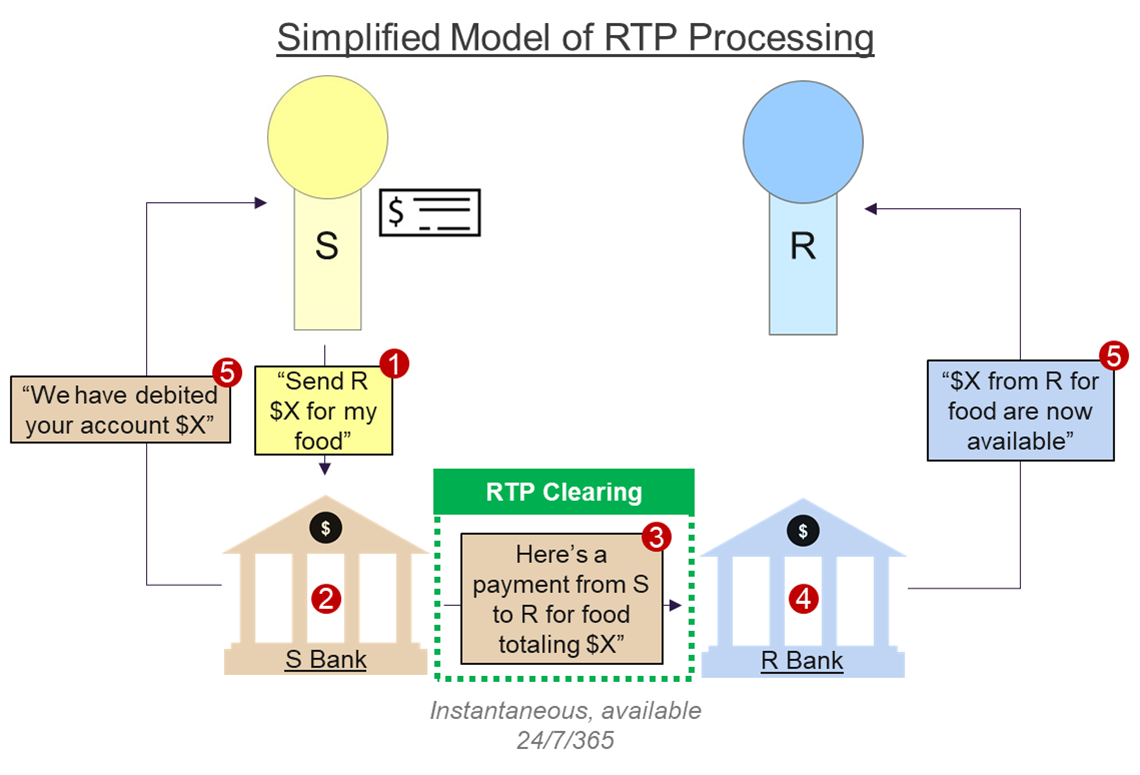

How does a RTP transaction work?

RTP is like a instant cheque payment — you specify what account you want to draw funds from, how much, what it’s for, and to whom it’s going. To help us better understand RTP, we’re going to rewind the clock a bit to understand how a cheque payment works and then map those concepts onto a RTP transaction.

Apologies in advance to the CTPs, CTP candidates, and payments junkies reading this comically oversimplified summary of nuanced and complex payment networks

How Cheques Work:

Cheques (aka “Bills of Exchange”) have been around since at least the ninth century BC and have functionally remained the same ever since. At their core, cheques are a set of instructions which tell a receiver’s bank how much to credit the receiver’s account and which bank will need to be contacted in order to send the funds.

To settle the transaction, bankers in the past would meet at clearing houses to net out transactions and determine how much money needed to be transferred from one bank to the other at the end of each business day. The example above is for a single cheque, but in practice, banks collect all of the cheques for the day, tally up the deposits and payments via the clearinghouse, and then only exchange the net balance (difference between cheques deposited and written) with other banks after the end of the day.

Today, this process is done electronically, with some cheques being processed physically, but with an increasing number being converted to ACH payments before being processed. Given their electronic nature, ACH is capable of sending multiple payments destined for different accounts in what is called a batch. This cuts down on processing costs and complexity.

With that framework in place, let’s tie this information back to RTP.

How RTP Works:

RTP files function similar to cheques in that they are routed through a clearing system and contain information related to the payment, but differ in that the payment message is initiated by the sender’s bank rather than the receiver. This reduces the counterparty risk (i.e. the risk of a bad cheque “bouncing”) inherent in check transactions.

This leaves the execution of an RTP transaction feeling much more akin to a wire transfer despite the look and feel of an ACH — doubly so given that transactions are run individually rather than in batches. This makes RTP good for one-time payments and daily living expenses, but leaves open questions around how RTP debit-style (i.e. bill pay) transactions would work (maybe a recurring “yes” on Request for Payment is the solution?)

The other distinguishing feature is the level of information which can be included along with the transaction. This is due to the data-rich file format (ISO 20022) Real-Time Payments around the world currently (or will soon) utilize. This could serve as the catalyst to revolutionize cross-border payments and further integrate the global economy.

Whew! There’s a lot to cover with this topic: everything from international data standards to replacing credit cards to daily payroll is wrapped up in RTP.

If you’re interested in learning more about this and other payment topics subscribe below and check out my 25 day tweet thread challenge where I’m covering a host of payment (and Christmas Tree) related topics!

Cheers,

-Wilson

Further Reading:

Other Posts in this Series — Coming soon

Encyclopedia of World Trade (it’s a textbook, so maybe just skim the eBook on Google Books)

Overview of RTP from Payments Journal

* Disclosure * My professional work involves payments strategy for a large US FI which includes real-time and faster payments networks. It is important that I make this abundantly clear: The views and opinions presented are strictly my own and do not represent the views of Truist.