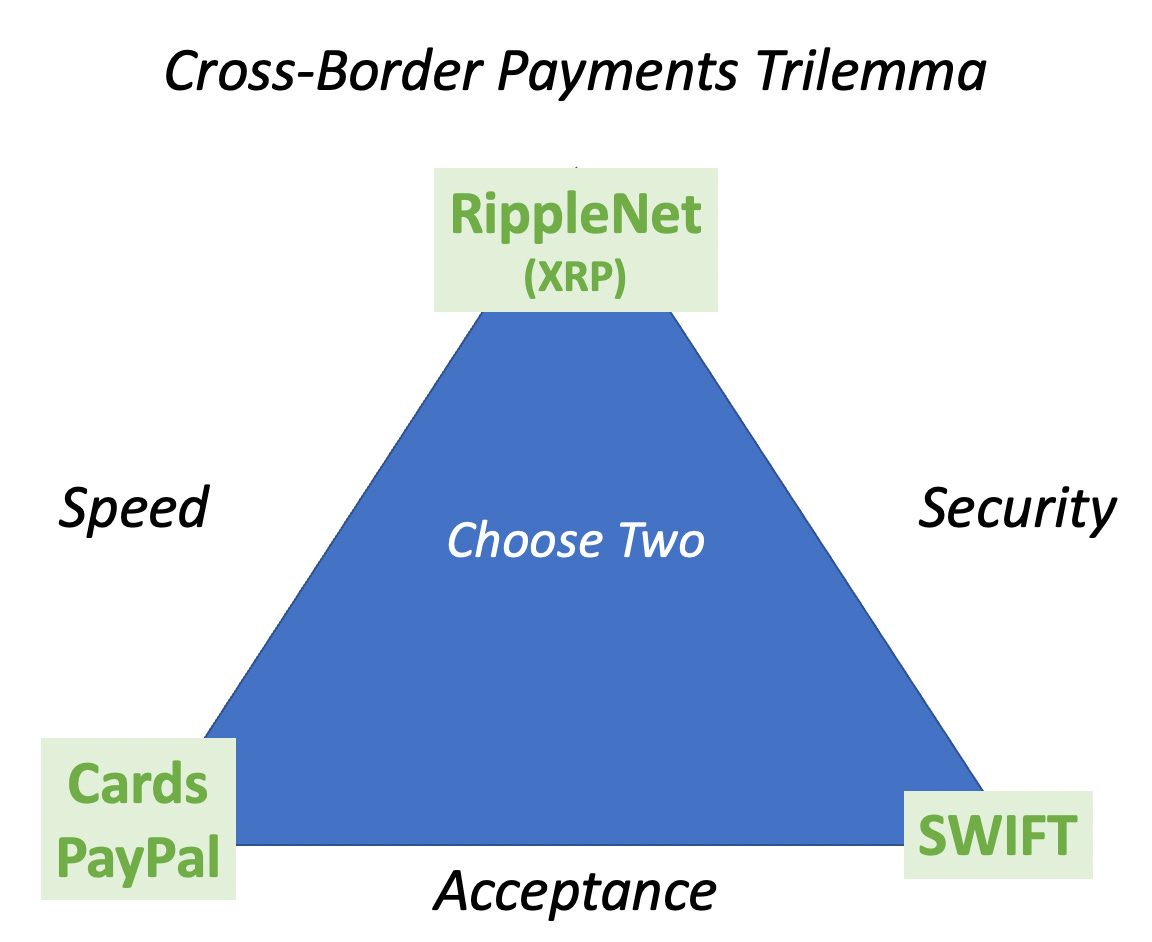

Solving the Cross-Border Payments Trilemma

Speed, Security, & Acceptance are keys to international commerce; but you're often stuck with choosing just two. SWIFT's latest test of CBDCs & tokenization may bring some big changes

When selecting a cross-border payments network to route a transaction, senders can choose something that’s is fast, safe, or widely accepted, but rarely all three. The biggest players — Card Networks & PayPal, Ripple, and SWIFT — each sit in niche corners, because solving for all three at once is difficult and expensive.

That said, SWIFT’s recent announcement could solve their speed issues and undercut the advantages Ripple, PayPal, and the Card Networks have enjoyed for years:

SWIFT has successfully shown that Central Bank Digital Currencies (CBDCs) and tokenised assets can move seamlessly on existing financial infrastructure – a major milestone towards enabling their smooth integration into the international financial ecosystem. — SWIFT Press Release. October, 5, 2022

This means that, without (major) changes to its network, SWIFT can…

operate with CBDCs as payment and payout currencies in a matter of minutes rather than days

explore sending tokenized assets (bonds, equities and cash) across its network

…for over 11,000 banks around the world.

The news is important because it softens the competitive advantage of non-fiat currency payments currently enjoyed by Ripple and (now) PayPal and speed-of-settlement enjoyed by Card Networks, PayPal, and Ripple.

CBDCs: SWIFTs push for relevancy

In completing test CBDC transactions across separate distributed ledger technologies (DLT; or colloquially, “blockchains”), SWIFT is pushing to remain relevant in a world where 26 countries — including China, Korea, and Saudi Arabia — have already piloted or launched tech that would make correspondent banking a thing of the past.

SWIFT successfully completed CBDC-to-CBDC transactions across different ledger technologies. By including the European Central Bank’s (ECB) largest members in their tests, SWIFT is positioning itself as THE solution for the in-progress Digital Euro.

But to make sure that countries like the United States (who is the notable laggard among G20 countries) don’t get excluded, Fiat-to-CBDC transactions were also successfully tested using a real-time gross-settlement system (think RTP). This point is huge as many countries around the world look to introduce or expand ISO 20022 compliant real-time payment rails in the coming years.

To quote SWIFT again:

The success showed that the blockchain networks could be interlinked for cross-border payments through a single gateway, and that SWIFT’s new transaction management capabilities could orchestrate all inter-network communication.

Tokenization: SWIFTs potential new revenue stream

Tokenization is the process of issuing assets as tokens (unique identifiers) on a network based on smart contracts. The assets involved can be everything from stocks and bonds to modern art and the royalties on a musician’s catalog. SWIFT chose to go with the larger and more lucrative stocks and bonds route.

[We] explored 70 scenarios simulating market issuance and secondary market transfers of tokenised bonds, equities and cash. It successfully served as a single access point to various tokenised networks and showed its infrastructure could be used to create, transfer and redeem tokens and update balances between multiple client wallets, as well as provide interoperability between different tokenisation platforms and existing account-based infrastructure.

By serving as the bridge between different token networks, SWIFT can continue to stay relevant while also leveraging its position to generate additional revenues from a potentially $24T market. The funds can then be used to further improve the network and strengthen its competitive moat.

How the competitors are responding

Strengthening Security:

Visa and JP Morgan did the exact same thing as SWIFT — linking the two organization’s blockchain networks — but with more of a focus on reducing fraud and failed transactions.

Adding Acceptance:

Ripple announced expansions of its On-Demand Liquidity (ODL) services into France and Sweden. ODL allows for fiat-to-fiat transactions using Ripple’s XRP token as the bridge. The service is already active in 22 destination countries, so an expansion into two large European markets will be huge for the company.

In the same announcement with Visa, JPM also announced that Deutsche Bank will be joining the Confirm blockchain product, expanding the interoperability

Mastercard recently launched crypto trading for its bank and fintech partners. While it won’t solve all of cross-border payments, it is a step in the right direction.

Reducing Acceptance…

PayPal has its own woes, so there’s not a whole lot of news coming up for their Cross-Border work as of late.

What happens next?

As with the advent of any new technology, there are strong first mover advantages due to network effects. However, the SWIFT has a deep moat which Ripple, PayPal, and the Card Networks have struggled to overcome in the past.

SWIFT which has rolled out a number of improvements to speed over the years — notably GPI — is still working on its “slow” image problem. The moats of tight security reputation and broad acceptance are going to be difficult for challengers to overcome. With

Ripple’s bank network currently has ~110 banks or 1% the size of SWIFT, so expect moves which rapidly broadening acceptance to be the strategy for the foreseeable future.

Given their $1.5B 2021 revenue compared to SWIFT’s $0.8B, Ripple has a lot more to work with in terms of investment capability.

PayPal has rooted itself in consumer cross-border payments where speed of transactions is still the dominant desire and demand for improvements is relatively inelastic. (barring other PR miscues) We can expect improvements in acceptance along with incremental improvements in security.

Card Networks have the most to lose in cross-border transactions because their raison d'etre is to seamlessly bridge (from the sender’s and receiver’s point of view) banks which aren’t connected with speed. The interchange fee which keeps the networks running is the toll paid for access to that fast, vast network. We might expect lots of flashy bits (like ~crypto payments~) to keep consumers and businesses engaged while security gets incrementally better.

Additional Reading

“The 10x potential of tokenisation”, Rajeev Tummala, Rachel Roch, and Xin Yi Tan of HSBC (2020)

[dated] “Ripple and Swift slug it out over cross-border payments”, Martin Arnold (2018)

Extra Bits

The CDBC test were powered by Capgemini and conducted with partner central(*) and commercial(^) banks including: Banque de France*, the Deutsche Bundesbank*, HSBC^, Intesa Sanpaolo^, NatWest^, SMBC^, Standard Chartered^, UBS^ and Wells Fargo^.

Banque de France and the Deutsche Bundesbank are the central banks of France and Germany, respectively.

Tokenized Asset tests were conducted with Citi, Clearstream, Northern Trust, and SETL